Commerce Tax FAQs

Table of Contents

Filing Requirement FAQs

What is Commerce Tax?

- Commerce Tax is a tax on a privilege of engaging in business in Nevada.

What entities are subject to Commerce Tax?

- Each business entity whose Nevada gross revenue in a taxable year exceeds $4,000,000 is required to file the Commerce Tax return.

Who is required to file the Commerce Tax return?

- Business entities with Nevada gross revenue over $4,000,000 during the taxable year are required to file the Commerce Tax return.

What is a business entity?

- Bank

- Business Association

- Business Trust

- C- or S-Corporation

- Holding Company

- Joint Stock Company

- Joint Venture*

- Limited-Liability Company (LLC)

- Limited-Liability Partnership

- Partnership

Professional Association - Savings and Loan Association

- Sole Proprietorship**

*Note: joint venture, except for a joint operating or co-ownership arrangement which meets the requirements of 26 C.F.R. §1.761-2(a)(3), Treasury Regulations §1.761-2(a)(3) that elect out of federal partnership treatment as provided by 26 U.S.C. §761(a).

**Note: Any other person engaging in a business in Nevada, including a natural person filing schedule E, part I, with their Federal Tax Return

What is “engaging in business”?

- Commencing, conducting or continuing a business;

- The exercise of corporate or franchise powers regarding a business;

- The liquidation of a business which is or was engaging in a business when the liquidator holds itself out to the public as conducting that business.

When is the Commerce Tax return due?

- The Commerce Tax return is due 45 days following the end of the fiscal year. Generally, the due date is August 14.

- If the due date falls on a weekend or holiday, the return is due on the next business day.

- If the business ceased to exist before the end of the taxable year, a short year return may be filed.

Where do I find the Commerce Tax return and instructions?

- The Commerce Tax Return and instructions can be found on Commerce Tax Types.

- Also, please see the Tax Forms page under Commerce Tax.

How can I file my Commerce Tax return?

- Online: You can e-file your Commerce Tax return using the Nevada Tax Center.

- Or you can mail it to:

Nevada Department of Taxation

Attention: Commerce Tax Remittance

P.O. Box 51180

Los Angeles CA 90051-5480

When is the Commerce Tax return due?

- 45 days following the end of the fiscal year.

- The Commerce Tax Return is usually due on August 14, unless that date falls on a weekend or holiday. In that case, the return is due on the next business day.

- If the business closed before the end of the tax year, a short year return may be filed.

What entities are exempt from Commerce Tax?

- Natural person, unless such person is engaged in a business and files Schedule C, E (Part 1) or F with the federal tax return;

- Governmental entity;

- Non-profit organization pursuant to section 501(c) of the Internal Revenue Code;

- Business entity organized pursuant to NRS 82 or NRS 84;

- Credit union;

- Grantor trust, excluding a trust taxable as a business entity for federal tax purposes;

- Estate of a natural person, excluding an estate taxable as a business entity for federal tax purposes;

- Certain REITs – Real Estate Investment Trusts;

- REMIC – Real Estate Mortgage Investment Conduit;

- Trust qualified under section 401(a) of the Internal Revenue Code;

- Passive Entity;

- Entity, which only owns and manages intangible investments, such as stocks, bonds, patents, trademarks;

- Participant in an exhibition NOT required to obtain state business license (NRS 360.780);

- Any person or entity which is prohibited from taxing pursuant to Constitution or law.

What is the $4,000,000 threshold?

- $4,000,000 is the standard amount a business entity is allowed to deduct from its Nevada gross revenue before the Commerce Tax is imposed.

I am a sole proprietor and I am exempt from the Nevada Business License. Am I exempt from the Commerce Tax?

- No. However, if your Nevada gross revenue during a taxable years is $4,000,000 or less, you are no longer required to file a Commerce Tax return for 2018-2019 tax year and after.

- If your Nevada gross revenue during a taxable year is over $4,000,000 you are required to file a Commerce Tax return.

I am a small business owner and my revenue is less than $4,000,000. Do I have to file the Commerce Tax return?

- No. Starting 2018-2019 tax year there is no Commerce Tax filing requirement for the businesses with the Nevada gross revenue of $4,000,000 or less during the taxable year.

I received a Form 1099-MISC from the company I work for here in Nevada. Am I a business entity?

- Yes. Your company treats you as an independent contractor. Independent contractors are subject to Commerce Tax.

- If you file Schedule C with your Federal income tax return and your Nevada gross revenue is over $4,000,000, you must file a Commerce Tax return.

I have a rental property in Nevada. Am I a subject to the Commerce Tax?

- Yes. According to Commerce Tax law, rent is NOT passive income.

I am registered with the Nevada Secretary of State but my corporation makes $0. Do I have to file the Commerce Tax return?

- No. Starting 2018-2019 tax year a Commerce Tax filing requirement for those with Nevada gross revenue of $4,000,000 or less has been eliminated.

- However, if the gross revenue of your corporation exceeds $4,000,000 during the taxable year in the future, you will be required to file a Commerce tax return for your business for that taxable year.

My Nevada business closed during the year. Do I have to file the Commerce Tax return?

- Yes. To close the Commerce Tax account with the Department of Taxation you have to file a final Commerce Tax return for your business.

My business is incorporated outside of Nevada. Does it have a Commerce Tax filing requirement?

- For businesses located outside of Nevada, a minimum connection with Nevada and $4,000,000 Nevada gross revenue are both required in order for them to be subject to Commerce Tax.

- Review NAC–363C: COMMERCE TAX of the Commerce Tax Regulations.

- The Department also developed a Nexus Questionnaire to help out-of-state businesses to determine their filing requirement.

Our Nevada company has subsidiaries in Nevada and in other states. It files a consolidated Federal tax return. Can it file a consolidated tax return for the Commerce Tax?

- No. Each entity has to determine its own filing requirement and file its own return, if a filing requirement exists.

Registration FAQs

What entities have to register for Commerce Tax?

- Business entities with Nevada gross revenue exceeding $4,000,000 during the taxable year should register for Commerce Tax.

- For the list of entities and the definitions please refer to Filing Requirements FAQs.

How do I register my business for Commerce Tax?

- Complete the Nexus Questionnaire.

- Mail the form to the Nevada Department of Taxation, 3850 Arrowhead Dr., 2nd Floor, Carson City, NV 89706

- See also Commerce Tax Types for more forms and information.

Do exempt entities have to register for Commerce Tax?

- No. Exempt entities are not required to register for Commerce Tax. The list of exempt entities can be found in Filing Requirements FAQs.

Who can file the Exempt Status Entity Form?

- Exempt entities that have been registered for Commerce Tax and whose Nevada gross revenue exceeds $4,000,000 during the tax year can file the Exempt Status Entity Form:

English PDF || Spanish PDF - We recommend that you review the list of exempt entities in Filing Requirements FAQs and the instructions on the second page of the form before you submit it.

- See also Commerce Tax Types.

Is the Commerce Tax registration different from signing up to use the Nevada Tax Center?

- Yes, those are two different procedures. The Commerce Tax registration is a formal procedure of registering businesses with the Nevada Department of Taxation for the Commerce Tax.

- The Nevada Tax Center allows businesses to file and pay the Commerce Tax return online.

How do I sign up to use the Nevada Tax Center for online tax filing?

- Visit the Nevada Tax Center and create an account.

- You will need an access code from your Welcome Letter.

Where can I find the Nexus Questionnaire and Exempt Status Entity Form?

- Download the Nexus Questionnaire form here.

- See Commerce Tax Types for more forms and information.

- Exempt Status Entity Form: English PDF || Spanish PDF

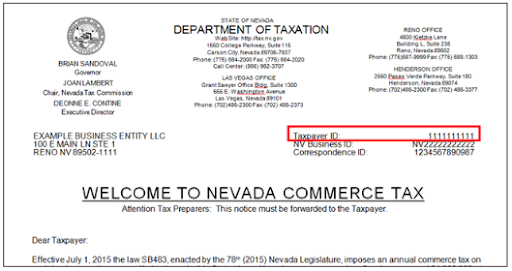

What is “Taxpayer ID” or “Tax ID” or “TID”?

- Taxpayer ID, Tax ID or TID refers to the 10-digits number assigned to the entity by the Nevada Department of Taxation.

- The Taxpayer ID for the Commerce Tax is located at the top right-hand corner of the Welcome Letter:

Where do I mail the Nexus Questionnaire or the Exempt Status Entity Form?

- Mail the forms to:

Nevada Department of Taxation

3850 Arrowhead Dr., 2nd Floor

Carson City, NV 89706

Return and Payment FAQs

How can I pay my Commerce Tax liability?

- You can pay online when filing the return electronically via the Nevada Tax Center or mail a check with the return to the address above.

- Payments of $10,000 or more in aggregate are required to be done electronically.

- See also: Returns, Payments, Credits and Refunds.

Do I have estimated payments for Commerce Tax during the year?

- Estimated payments are not required.

Can I request an extension to file and pay the Commerce Tax return?

- Yes. If you have good cause, a 30-day extension can be requested before the due date of your Commerce Tax return.

- To request an extension, complete the 30-Day Extension of Time to File and Pay Commerce Tax Form:

English PDF || Spanish PDF - The application should be postmarked before the date on which the payment of the Commerce Tax becomes due.

- Mail it to:

Nevada Department of Taxation

3850 Arrowhead Dr.

Carson City, NV 89706 - If the Commerce Tax is paid during the period of the extension, no penalty or late charge will be imposed for failure to pay the Commerce Tax at the time required.

- However, interest will accrue at the rate of 0.75 percent per month from the date on which the amount of tax would have been due without the extension until the date of payment.

Commerce Tax Credit for Modified Business Tax FAQs

See also: Modified Business Tax FAQs

What is the Commerce Tax credit?

- The Commerce Tax credit is a non-refundable credit applied toward a Modified Business Tax liability for your business.

- It equals 50% of the Commerce Tax paid.

Who is eligible for the Commerce Tax credit?

- A business, which pays the Commerce Tax and the Modified Business Tax, is eligible for the Commerce Tax credit.

- Special rules apply to the members of an affiliated group.

How do I take the credit?

- Complete the MBT Return-General Businesses 7/1/23 to Current Tax Return:

English PDF** || English XLSX || Spanish PDF || Spanish XLSX - The form includes a line to report the Commerce Tax credit.

When can I take the credit?

- You can take the credit for any of the 4 calendar quarters immediately following the end of the Commerce Tax year, June 30th.

- Example: The Commerce Tax year ends on June 30, 2016. On August 15, 2016 a business filed its Commerce Tax return and paid $1,000 in Commerce Tax. $500 of the Commerce Tax credit may be applied to the Modified Business Tax liability for any of the quarters ending September 30, 2016, December 31, 2016, March 31, 2017, and June 30, 2017.

What if the credit is more than my Modified Business Tax liability?

- The Commerce Tax credit is valid for 4 calendar quarters immediately following the end of the Commerce Tax year, June 30th.

- If you applied the credit to the Modified Business Tax liability for the quarter ending September 30th and there is still an unused portion of the credit left, you may apply the unused portion in the following quarter ending December 31st and so on until the credit is all used or the credit expires.

- Example: The Commerce Tax year ends on June 30, 2016. On August 15, 2016 a business filed its Commerce Tax return and paid $20,000 in Commerce Tax.

The Modified Business Tax liability before applying the Commerce Tax credit for the quarter ending:

- September 30, 2016 is $3,000

- December 31, 2016 is $3,500

- March 31, 2017 is $3,000

- June 30, 2017 is $3,000

The Modified Business Tax Liability after applying the Commerce Tax credit for the quarter ending:

- September 30, 2016 – $0 (the remaining credit carryforward to the next quarter is $7,000)

- December 31, 2016 – $0 (the remaining credit carryforward to the next quarter is $3,500)

- March 31, 2017 – $0 (the remaining credit carryforward to the next quarter is $500)

- June 30, 2017 – $2,500 (all credit is used)

- Example: The Commerce Tax year ends on June 30, 2016. On August 15, 2016 a business filed its Commerce Tax return and paid $20,000 in Commerce Tax.

The Modified Business Tax liability before applying the Commerce Tax credit for the quarter ending:

- September 30, 2016 is $2,000

- December 31, 2016 is $2,500

- March 31, 2017 is $2,000

- June 30, 2017 is $2,000

The Modified Business Tax Liability after applying the Commerce Tax credit for the quarter ending:

- September 30, 2016 – $0 (the remaining credit carryforward to the next quarter is $8,000)

- December 31, 2016 – $0 (the remaining credit carryforward to the next quarter is $5,500)

- March 31, 2017 – $0 (the remaining credit carryforward to the next quarter is $3,500)

- June 30, 2017 – $0 (the unused portion of the credit of $1,500 expires)

Can I still take the credit, if I pay the Commerce Tax partially or late?

- If you pay only part of the Commerce Tax due you are entitled to 50% of the amount you paid to be taken as the Commerce Tax credit.

- If you pay the Commerce Tax late, you may still take the credit in any of the four eligible quarters immediately following the end of the Commerce Tax year, June 30th.

- You may need to amend a previous Modified Business Tax return in order to apply the credit.

- Example 1: For the Commerce Tax year ended June 30, 2016, a business owed $1,000 in Commerce Tax, but paid only $200. The Commerce Tax credit the business can apply to the Modified Business Tax liability is $100.

- Example 2: For the Commerce Tax year ended June 30, 2016, a business was able to pay the Commerce Tax in May 2017. It may still claim the credit for the quarter ending June 30, 2017 and/ or amend the Modified Business Tax returns for the quarters ended September 30, 2016, December 31, 2016 and March 31, 2017.

If I pay the Commerce Tax late, during what period can I amend my Modified Business Tax return to take the credit?

- A Modified Business Tax return may be amended within three years after the last day of the month following the calendar quarter for which the overpayment of the Modified Business Tax was made.

What are the special rules for the members of an affiliated group for taking the credit?

- If an affiliated group is structured in a way that one of the members is a central employer for other members of the affiliated group.

- Such an employer may apply to the Department to be designated as a payroll provider in order to claim the Commerce Tax credit the other members of the affiliated group have generated.

- Such employer must demonstrate that it is a member of an affiliated group which:

- Provides payroll services for one or more members for the affiliated group;

- Pays wages to employees who provide services on behalf of one or more members of the affiliated group; and

- Reports and pays Modified Business Tax on wages paid to employees who provide services on behalf of one or more members of the affiliated group; and

- Each member of the affiliated group for which a Commerce Tax credit is claimed would have a liability for the Modified Business Tax if the persons were treated as employees of the affiliate rather than as employees of the employer.

- Example: Parent Inc. owns 100% of PP LLC, 80% of Stores Front LLP, and 75% of Factory Inc.

- Stores Front LP and Factory Inc. have employees and pay Commerce Tax, Parent Inc. has no employees, but pays Commerce Tax.

- The sole purpose of PP LLC is to provide the payroll services to Stores Front LLP and Factory Inc.

- PP LLC may apply to the Department to obtain the affiliated group payroll provider status in order to claim the Commerce Tax credit generated by Stores Front LLP and Factory Inc. on its Modified Business Tax return.

- Parent Inc. has no employees; therefore, the Commerce Tax generated by Parent Inc. may not be taken as a credit towards the Modified Business Tax liability under PP LLC.

Does an unrelated third party payroll company that prepares payroll and files payroll reports on behalf of that business have to apply for the payroll provider status?

- No, the unrelated third party payroll company does not have to apply for the payroll provider status.

- It should simply file the Modified Business Tax return on behalf of the business reporting the amount of Commerce Tax credit the business is entitled to.

What is an affiliated group?

- An affiliated group is a group of two or more business entities, each of which is controlled by one or more common owners or by one or more members of the group.

- “Controlled by” means the direct or indirect ownership, control or possession of 50% or more of the ownership interest in a business entity.

Does a business that is a member of an affiliated group, but pays the Commerce Tax and generates its own Modified Business Tax liability, have to apply for the payroll provider status?

- No, such business may apply 50 percent of the Commerce Tax it paid as credit on its Modified Business Tax return without filing the Affiliated Group Payroll Provider application.

How do I apply to be designated as a payroll provider?

- Use the Affiliated Group Payroll Provider Application & Instructions:

English PDF || Spanish PDF - Mail the form with the supporting documents to: Nevada Department of Taxation, 3850 Arrowhead Drive, Carson City, NV 89706

Note: FAQs are for general guidance only. For written advice as it relates to your business, request an advisory opinion from the Department.

More Information

- Appeals FAQs

- Audits FAQs

- Bank Branch Excise Tax FAQs

- Cannabis Establishment Tax FAQs

- Cigarette & Other Tobacco Products (OTP) FAQs

- Commerce Tax FAQs

- Consumer Use Tax FAQs

- Estate Tax FAQs

- Exhibition Facilities Fee FAQs

- Gold & Silver Excise Tax FAQs

- Hearings FAQs

- Insurance Premium Tax FAQs

- Liens FAQs

- Liquor Tax FAQs

- Live Entertainment Tax FAQs

- Locally Assessed Property Tax FAQs

- Marketplace Facilitator/Seller FAQs

- Modified Business Tax (MBT) FAQs

- Nevada National Guard Tax Holiday FAQs

- Off Highway Vehicles & Fuel Tax FAQs

- Peer-to-Peer FAQs

- Real Property Transfer Tax FAQs

- Sales Tax FAQs

- Secure Email FAQs

- Short Term Lessor Fee FAQs

- Tax Credits FAQs

- Tobacco Products – 2024 Updated FAQs

- Transportation Connection Tax (TCT) FAQs

- US Dept of State Tax Exemption Card

- Veterans’ Tax Exemptions FAQs